Defined contribution (DC) schemes are the fastest-growing investor segment in the UK. With current assets under management estimated at approximately £600bn, occupational DC pension schemes are projected to reach £800bn by 2030.

We have been closely following the UK pension reform process since it began under the previous Government, spanning the various segments of the pensions market - our earlier report UK Pension Schemes provides a useful overview of recent developments in this space.

In this article we focus specifically on the DC segment, addressing some of the recurring questions we receive from private capital managers seeking to access this growing pool of capital.

- What is the difference between a Master Trust (MT) and a Group Personal Pension (GPP), and does it matter?

- Should private capital managers target single-employer trust pension schemes?

- What strategies can private capital managers use to address pension schemes’ sensitivity to fees?

- What role do consultants play?

- How will pension mega-funds shape the market?

Upcoming webinar

Expanding your investor base: the UK DC and European and UK private wealth markets

Several of these questions are closely tied to ongoing product development trends in the DC and wealth space, which we will explore in greater detail in our upcoming webinar on 9 December.

Register for webinar

What is the difference between a Master Trust and a Group Personal Pension (GPP) and does it matter?

Occupational DC schemes include both trust-based and contract-based schemes (mostly GPPs) each representing about half of the market.

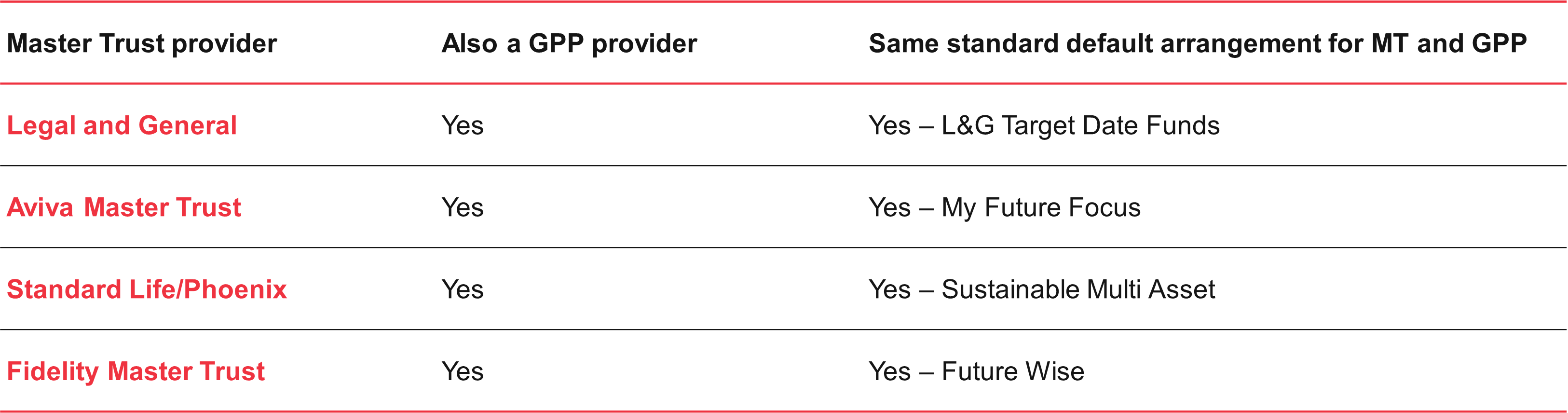

Some of the largest DC providers in the UK offer both GPPs and Master Trusts – for example, Aviva, L&G, Scottish Widows, and Standard Life. While there are some differences between GPPs and Master Trusts, from an allocation perspective they often overlap significantly. These providers often use the same standard default arrangement across both types of pension, meaning that a provider’s default arrangement may be much larger than the size of its Master Trust.

Figure 1: GPPs and Master Trusts from large UK DC providers

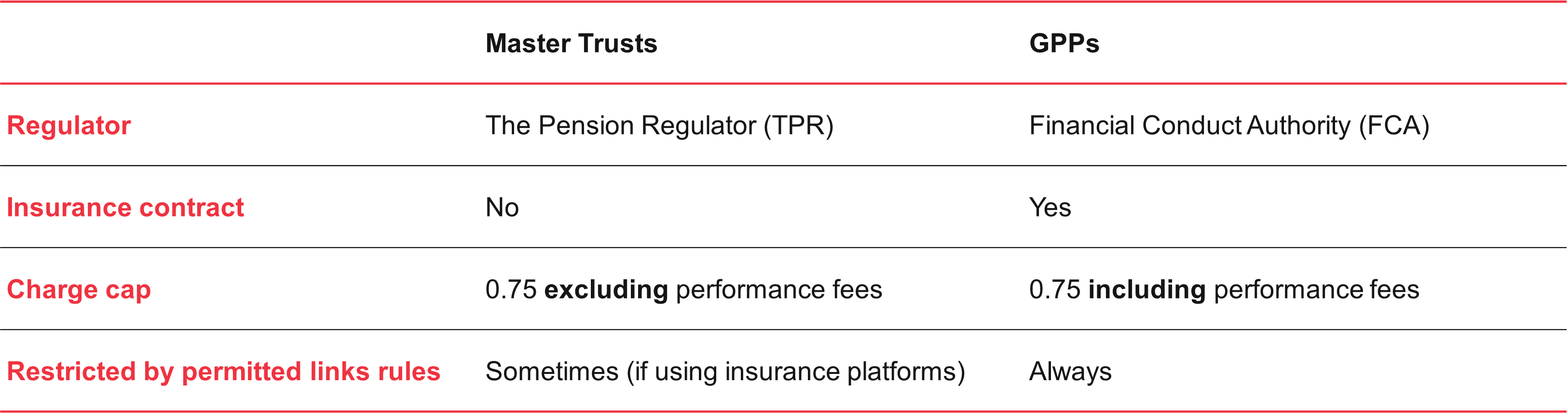

However, there are some key differences between these two pension types that influence how they invest in private markets and shape their respective product requirements. These are summarised in the table below:

Figure 2: Summary of key differences

GPPs, as insurance contracts, are regulated differently from trust-based arrangements. One clear area of impact for managers looking to attract DC capital is that the charge cap for GPPs still includes performance fees. It is therefore difficult for them to invest in funds with carried interest or performance fee features. Where Master Trusts and GPPs overlap, it is likely that the schemes will opt for the lowest common denominator (and follow the rules for contract-based schemes set by the FCA, which do not allow performance fees within the charge cap calculation). Many stakeholders have raised this discrepancy with the Government; however, we await any indication of action being taken.

The other key difference between Master Trusts and GPPs is that the latter are always within scope of the FCA’s permitted links rules, whereas Master Trusts are not – unless they invest through life platforms. For example, the Nest Master Trust operates under a custodian model and is therefore not affected by these rules. By contrast, Aon’s Master Trust, which uses the Aegon insurance platform, becomes indirectly subject to them.

This exposure to the permitted links regime helps explain why Long-Term Asset Funds (LTAFs) are often required in this market – a dynamic discussed in more detail in our previous report.

Should private capital managers target single-employer trust pension schemes?

Single trusts will remain a feature of the DC market although with a less significant market size.

At £39bn1, this is a relatively small market with a great degree of fragmentation across 890 single trusts. It is expected to decrease further given the pursuit of greater consolidation in the DC market. This expectation of further consolidation can be a barrier for investing in private assets as schemes that anticipate merging into a Master Trust are often reluctant to make new illiquid commitments, given the uncertainty of transition and the desire not to constrain future investment strategies.

That said, there are some single employers that are large in size and have an appetite to invest in alternative asset classes. Large, well-established employers, typically with thousands of employees, legacy defined benefit arrangements, and a strong culture of providing pensions as part of their employee value proposition, are more likely to retain their own trust e.g. HSBC, JP Morgan.

From our analysis of the top 10 largest companies in the FTSE100, the majority of these large firms, six still have their own trust, two have joined a master trust and two provide contract-based group personal pensions.

In short, single-employer trusts represent a shrinking opportunity. A small number of schemes remain that could act as cornerstone investors for new DC products; however, only a limited group of large UK corporates have the scale and resources to develop their own investment programmes and to include private assets within them.

What strategies can private capital managers use to address pension schemes’ sensitivity to fees?

Given the historical focus on costs, many DC schemes have invested in low-cost funds to date. This is partly cultural, but Government regulation has played a part in compounding this. Trustees and managers of occupational pension schemes which are used to meet employers’ automatic enrolment duties must ensure that the costs and charges borne by the scheme do not exceed 0.75%. This is known as the “charge cap”. In fact, the charge cap has been so “successful” many schemes are operating with aggregate fee levels below the 0.75% cap.

The common challenges cited (real or perceived) around fees are:

- charge caps – 0.75% charge cap which in some cases includes performance fees (in particular GPPs and the default arrangements of Master Trusts if the same arrangement is used by the provider’s GPP offering);

- member fairness – performance fees may make it difficult to ensure that fees are attributed fairly between members. In this context, a much greater emphasis is put on valuations; and

- philosophical views and emphasis on long-term partnership – some providers, such as Nest, cite this as the biggest reason why they do not pay performance fees.

Figure 3: What are the most significant barriers to investing in private markets in your DC trust?

Source: The Defined Contribution Investment Forum, 2024.

DC pension schemes are exploring a range of innovative fee structures and investment approaches to optimise private capital allocations. Going forward there might be a different emphasis on the profile of management fees versus performance fees, but this will depend on a range of factors not least the approach taken to fee negotiations by DC pension schemes. Additionally, co-investment is also often discussed as a way to achieve a more favourable fee profile on a blended basis.

The forthcoming “Value for Money” (VfM) framework is designed to shift the focus of DC workplace pensions onto delivering better long term outcomes for savers by making performance, costs, and quality directly comparable across schemes and by forcing action where value is poor. This should help move away from a narrow emphasis on the lowest fees toward overall value, with a strong emphasis on net investment performance after costs – ultimately more supportive of private capital investments.

Due to having different regulators, the VfM framework will be implemented separately by the FCA and TPR. The framework should apply consistently across both pension schemes irrespective of the regulator, however discrepancies may appear given the fractured implementation.

In summary, while there are encouraging tailwinds as industry bodies and policymakers place greater emphasis on value over cost, managers targeting the DC market must remain flexible on fees. This often involves structuring fund-of-one solutions tailored to the specific requirements of DC investors. Conversely, DC providers should be mindful of the risk of adverse selection, whereby an excessive focus on cost may lead them to miss out on higher-quality managers. Continued education and collaboration with pension trustees are essential to ensure that private capital investments remain aligned with fiduciary duties.

What role do consultants play?

Consultants play a central role in the UK DC market. As shown in Figure 4, they are involved at different points in the investment decision-making process, advising both employers and DC scheme providers. Their influence can be grouped into four main areas:

Figure 4: Flow of investment decision-making in DC Trusts and GPPs

Advising employers

- Scheme design: help employers decide the type of scheme they should select (trust vs contract-based), contribution structures, salary sacrifice.

- Provider selection: running tenders, benchmarking costs, assessing service quality.

- Default strategy: helping employers choose a default arrangement – may be the standard default, an alternative default (e.g. ESG-focused), or a bespoke default.

- Ongoing governance: support with value-for-money assessments, annual review of provider and default funds.

Investment advice to trusts

- Default strategy design and fund range: this includes advice and training on new topics such as investment in illiquid assets.

- Note: all trust-based occupational pension schemes (including both single-employer trusts and Master Trusts) are required to take proper investment advice under Section 35 of the Pensions Act 1995

- For master trusts: many master trusts receive investment advice from regulated subsidiaries but are still likely to engage external consultants to provide independent validation and demonstrate objectivity.

- For single trusts: consultants are more heavily involved in strategic asset allocation and default design.

Indirect influence in the GPP market

- GPPs are not required to take external investment advice (not covered by Section 35 Pensions Act 1995 obligations). However, several GPP providers still use consultants, particularly given the previously mentioned overlap with Master Trusts.

Design investment solutions hosted on other platforms

- Some consultants package their own multi-asset or target-date strategies and arrange for these to be hosted on the large insurers’ DC platforms. e.g Mercer Elect (partnering with Aviva) and Mercer Smart Pensions (partnering with the Smart MT).

While managers often prioritise relationships with consultants advising DC providers - given their direct influence over investment mandates - there is equal merit in engaging with consultants more broadly. These firms also advise employers on scheme selection and default fund design, meaning their views ultimately shape whether value and performance are prioritised over cost.

How will pension mega-funds shape the market?

The Government will legislate to ensure each non-associated multi-employer DC pension provider / scheme has at least one “main scale default arrangement” with £25bn in AUM from 2030. There will be a transition pathway to allow additional time for some schemes to reach this scale, but the expectation is for all non-associated multi-employer DC schemes to have reached this target by 2035.

The Government’s view is that funds around £25–50bn provide significant benefits and even greater benefits are delivered when assets are above £50bn. The evidence presented by the Government pushes the idea that larger schemes will have greater capabilities to invest directly or co-invest in a broader range of assets, particularly in private markets. However larger mandates from scaled-up pension providers may put more pressure on fees with external managers.

Beyond mega-funds, there are several other Government reforms driving scale and consolidation in the DC market, including:

- contractual override to allow bulk transfers from old or underperforming contract-based schemes into trust or contract-based schemes;

- underperforming schemes identified through the VfM framework will be forced to close and transfer assets/liabilities to another scheme; and

- small pension pot consolidation.

These reforms are expected to lead to significant consolidation – both among providers and within default arrangements. At present, only nine multi-employer DC providers have assets exceeding £25bn, and just five have achieved that scale within a default fund. By 2035, the UK DC multi-employer market is projected to comprise only 15 to 20 large “DC mega-funds,” down from more than 60 providers today.

For managers, this trend implies that fundraising and relationship efforts should be concentrated on these leading providers, as further consolidation is likely to reshape the market over the coming years.

Key takeaways

- Consolidation is reshaping the DC market, with 15–20 large “mega-funds” expected to dominate by 2035.

- Regulation drives product design, as charge caps and permitted links rules dictate how DC schemes can access private markets.

- Success requires adaptability, with flexible fee models and strong consultant relationships key to accessing DC capital.

Upcoming webinar

Expanding your investor base: the UK DC and European and UK private wealth markets

We will explore these themes, and what they mean for product development, in more detail during our upcoming webinar on 9 December.

Register for webinar

- Reported estimates of assets managed by single-employer DC trusts vary considerably between sources, reflecting differences in definitions, coverage, and reporting methodologies. While some sources estimate the current size at over £100bn, the House of Commons’ research Briefing for Pension Schemes Bill 2024-25 reported £39bn in single trusts across 890 trusts. The reason for the discrepancy is unclear, however, it is assumed that the House of Commons figures represent a narrower subset of the market - potentially limited to “active” or “non-micro” single-employer DC trust schemes - and portray a more accurate representation of the addressable market.